![]()

![]() Here’s a guest post from Mark Hooson at Moneysupermarket.com with advice about the pitfalls of buying guitars on credit..

Here’s a guest post from Mark Hooson at Moneysupermarket.com with advice about the pitfalls of buying guitars on credit..

Most guitarists, at some point in their life, will fall prey of ‘Guitar Acquisition Syndrome’. Characterised by the irrepressible and urgent need to acquire a guitar, regardless of its price or availability, the only cure for the syndrome is to hunt down that axe and hand over the cash!

Most guitarists, at some point in their life, will fall prey of ‘Guitar Acquisition Syndrome’. Characterised by the irrepressible and urgent need to acquire a guitar, regardless of its price or availability, the only cure for the syndrome is to hunt down that axe and hand over the cash!

Unfortunately, for most of us, paying for them can be a bigger stretch than a chord spanning five frets. The options are clear: you can attempt to save some cash until you can afford the guitar, buy it on finance – depending on the store, or you can put it on a credit card.

But is buying a guitar on a credit card ever a good idea? Let’s take a look at the pros and cons putting it on the plastic.

First off, because I’m a pessimist, let’s look at the cons.

Why you shouldn’t buy a guitar on a credit card

The main issue here is your ability to pay.

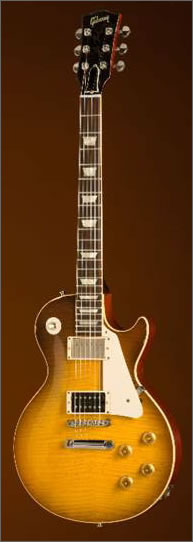

Of course by using a credit card you can get instant gratification and be home with your Gibson 1960 Les Paul Special or your Martin Eric Clapton signature acoustic as quick as a flash, but not only will you be paying the full price of the guitar, you’ll be paying the interest on the card too.

Traditionally, purchase credit cards are great for free, short-term credit – as long as you always pay your balance in full by the due date shown on your statement, but you will incur interest if you are unable to repay your balance in full every month.

Interest rates vary significantly, so if you don’t pay the full amount by the due date, and find yourself paying too much interest, you’ll have to go through the process of transferring the balance to a lower-rate card.

Why you might want to use a credit card to buy the guitar of your dreams

Even if you don’t have an over-active impulse-buying gland, there are still benefits to buying a high-priced guitar, like a Fender American Vintage ‘52 Telecaster, on a credit card.

Credit cards are a safe way to pay for a guitar, particularly if you are buying over the internet or phone.

If you buy anything on a credit card priced between £100 and £30,000, that turns out to be faulty or which you do not receive because the company goes bust, you can claim a refund from the card provider.

For the more exotic guitar-enthusiast, a credit card might be a good idea because they are accepted in virtually every country around the world – perfect if you spot that axe abroad you’ve been scouring the country for back home.

So, should you buy a guitar on credit?

It all comes down to your ability to pay. I for example, would love a Gibson J200, but I wouldn’t put it on a card because I wouldn’t be able to pay off the full balance before the end of the month, and would be stuck paying charges every month – making the guitar cost me a lot more than it would have if I’d paid up-front.

On the other hand, some cards have great promotional offers like loyalty points, cash back, or payments to support a charity.

It all comes down to what you can afford, and if you do opt for a card – be realistic, and make sure you compare rates and offers to make sure you get the most for your money.

[Mark Hooson writes for the financial group at Moneysupermarket.com, and is a guitar enthusiast]

One reply on “Should you ever buy a guitar on credit?”

Great advice. Buying with a credit card does give you peace of mind, as if something goes wrong the credit card company will stand up for you. However if you have to pay huge amount of interest, its not worth it.